Interest and Rationing: Price Controls in Theory and Practice

Central bankers are becoming very concerned about the persistence of structural inflationary forces. To lean against them, they are using the only tool in their arsenal – interest rate policy. Should we welcome this new enthusiasm for inflation fighting via high interest rates? Probably not. Not only is rate policy a particularly blunt weapon when it works; increasingly, it is also clear that we don’t know how they work and why. Interest rate hikes are a black box whose inflation-reducing function in the broader economy is poorly-articulated and even less well-understood.

The conventional explanation of the effect of rate hikes is one of expectations. According to this theory, central bank rate hikes shape the expectations of market participants about future credit conditions. An expectation of tight credit conditions will supposedly lower spending, in turn lessening pressure on prices. But the empirical validity is increasingly being challenged, even inside central banks. Moreover, throughout the past year, inflation expectations have been well-anchored. And yet inflation persists.

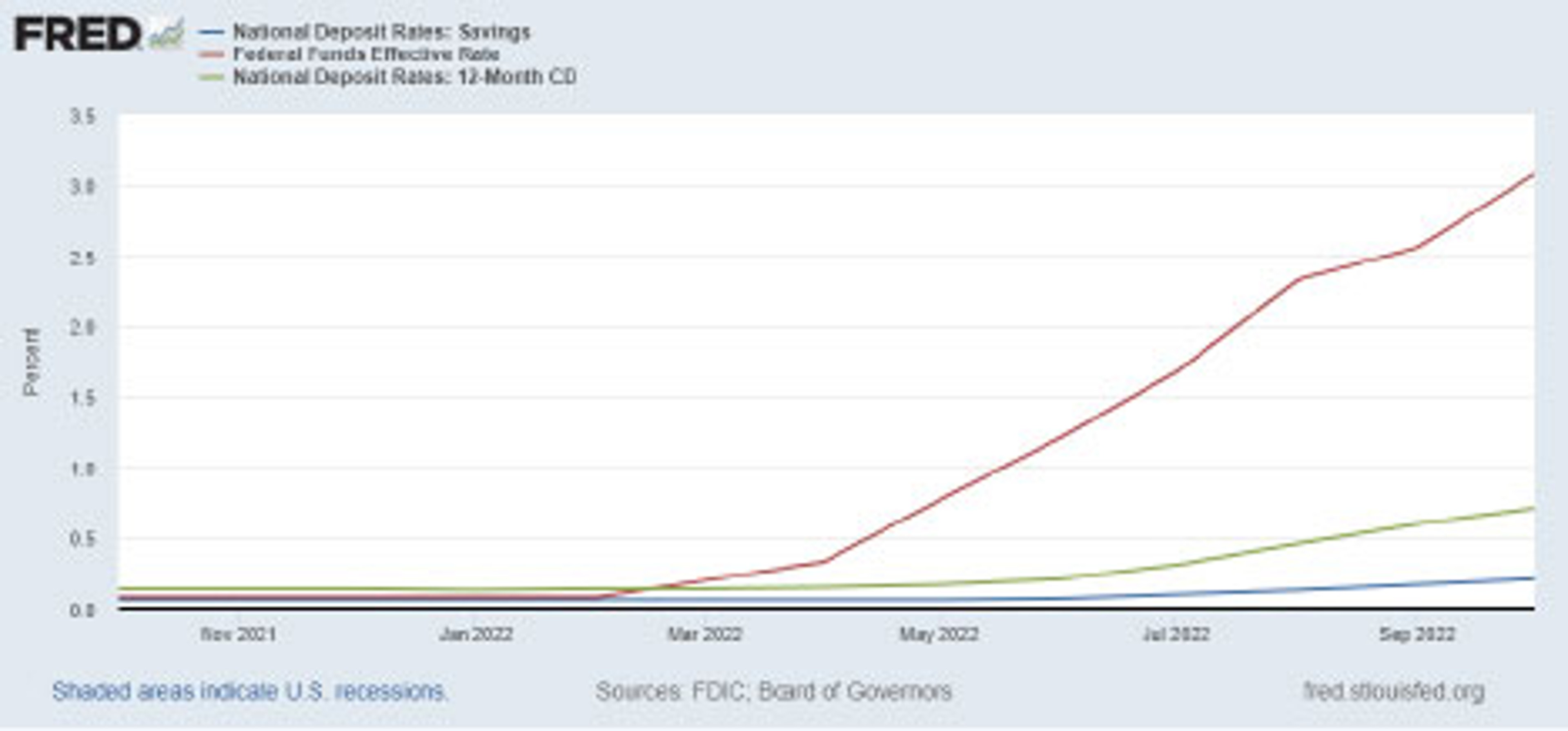

Another way of understanding how rate hikes work is that they encourage people to save more and spend less. For this to be true, we would have to see passthrough from rates into consumer savings products – in other words, you would have to observe the interest rate paid on bank deposits and CDs rise significantly with the central bank’s target interest rate. In recent history, this passthrough is not very high. Financial institutions largely pocket the spread between the high borrowing rate and the low rate they pay their depositors. Moreover, this effect is very dependent on the peculiarities of local institutions. For example, in the United States, most mortgages are fixed rate. Thus, borrowers who bought or refinanced at low interest rates will find their purchasing power increase relative to new buyers and renters who may still pay higher rent, even if inflation slows. On the other hand, in the United Kingdom, mortgages are variable rate, so the effect of rate increases might be larger. Thus, the effect on spending might be more evenly distributed and immediate.

But the most realistic explanation of how central bank interest rate hikes decrease inflation is through the labor market. Effectively, by raising borrowing costs, the central bank makes it harder for companies to run their operations, forcing them to lay off workers. This curtails workers’ consumption and, in turn, lowers demand. Economists even have a term for this – the non-accelerating interest rate of unemployment. In effect, central bankers are trying to put people out of work to maintain the price level. The burden of this, of course, falls on the most vulnerable members of society. Yet, even here, we are seeing what some humorously call “the honey badger labor market” – it doesn’t seem to care about hikes and is still very strong. In response central banks might overreact and tighten so much that they will cause an unnecessary recession.

The thing uniting all these theories of interest rates is that they treat inflation as a demand-side phenomenon. Drawing on lessons from the 1970s—whose own validity is somewhat debatable—many economists believe that output is largely fixed by technology and that inflation happens when there is too much demand from income earners for a fixed set of goods. The great fear of these economists is that inflation sets off an uncontrollable “wage-price spiral.” If the labor market is healthy, higher prices will make workers demand higher salaries, which will, in turn, cause employers to charge more for products. Interest rate hikes become a tool to lower the power of labor by making unemployment a more immediate prospect.

But what if such economists are drawing the wrong lessons? What if today’s inflation is structural, triggered by an artificial shock to the supply of critical goods in an economy? We forget that we are just coming out of one of the most catastrophic and disruptive events in human history: the COVID-19 pandemic. We are also in the middle of a major industrial war in Europe that has broken commodity markets. Of course, things are going to be outside of the ordinary, and firms with pricing power will take advantage of the situation.

In this context, rate hikes will not help. Even worse, by making it harder for firms to access credit, they will make it more difficult for us to restore the lost capacity that not only COVID-19 but almost two decades of low demand have destroyed. Some might even argue that a period of high inflation is the cost we must pay for that, and that we should do nothing.

How do we get around the problem of inflation and the inadequacies of an interest rate response? First, let us step back and look at the larger theoretical picture. In classical political economy, distribution among wages, profits, and rents is always the most important element of analysis. This has been replaced by neoclassical analysis, which at its heart is interested in agents’ decision-making under prescribed conditions. From the point of view of neoclassical economics, interest rate policy is about setting proper expectations to influence behavior. However, from the point of view of classical economics, interest rate policy rations credit. Instead of changing behavior through expectations, classical theory understands rationing as affecting the relationships among wages, rents, and profits. From this perspective, interest rate tools move the burden of adjustment onto wages from profits. By rationing credit, enterprises lower their profit expectations and thus cut back on new spending. The result is declining prospects for employment and the reduction of labor bargaining power. This, in turn, cuts down on consumption by wage earners and brings demand down in line with supply. Keeping the classical model in mind, the question for policymakers today is: how can we manage the distribution among rents, wages, and profits in a more equitable and precise way than interest rates allow?

One approach is that we must actively rebuild resiliency in critical categories of goods, so if their production is disrupted, we can fall back on spare capacity. But there are many unresolved questions that need addressing to make this approach work, and we lack the institutions to resolve them. Which categories of goods are most critical? Who carries the cost of spare capacity? We still have not created a process for understanding and answering these questions. Moreover, capacity-expanding investments tend to take a lot of time to install. This might get us to a high-employment, low-inflation future, but it does not help now.

Voluntary or mandatory savings could be a more immediate approach to reducing inflation. This could be in the form of a temporary inflation tax or in the encouragement of saving through new products. Under efficient markets, one would expect bank rates to respond to higher interest rates and encourage higher savers. But as discussed above, we have not seen such passthrough. In theory, a government product, like the already existing but capped Series-I bond could be offered as a competitor. But these products would have to be counter-cyclical and timed to pay out their coupon in a way that doesn’t create excess consumption demand down the road. Such an approach might be gentler on wage earners than rate hikes and will certainly reduce the cost of credit for firms needing to invest to produce scarce materials. Ideally, a savings policy would bring purchasing power forward in time, thereby giving investment the room to catch up with consumption and signaling to investors that they can expect their current outlays to be matched with future profits created by consumer spending.

But the most direct and controversial approach to fighting inflation today is price controls. When we talk price controls, the notion many people immediately think is the government setting specific prices on grocery items and clothes off the rack. A more targeted and realistic idea of price control policy is one in which the government does not mandate a single price for all sellers, but where it creates a price floor, or corridor. A great example is the interest rate itself, which is a kind of price corridor on the future price of money.

Also, while price controls are certainly a form of rationing, consider that market prices often are as well. Even if we assume a market with perfect competition and information, price plays the role of an optimal form of distributing scarce resources. And in the real world, different market segments, levels of monopoly, costs of capital, and other factors mean prices are often at least quasi-administered by private agents. If these sectors are critical inputs into other areas of the economy, then these privately, artificially administered prices will cause inflationary pressure on all kinds of companies. For these downstream goods, price only somewhat reflects the conditions of scarcity.

When a commodity is in short supply due to a temporary shock, like a war, price controls may be the only response to inflation that can ensure an economy survives the war at all. In such a case, immediate costs predominate, such as sustaining armies in the field. They can also apply to geopolitically-driven supply shocks short of war. If you are facing the prospect of losing access to some vital resource, you need to give firms and other economic actors access to capital to invest in substitutes. In this context, raising rates increases the cost of capital, thereby limiting the investment needed to break the bottlenecks that cause it in the first place; and more direct price interventions are the appropriate course of action.

Berggruen Fellow Isabella Weber’s work with the German government on price controls for natural gas is an excellent example of a context where price controls are the right approach. It responds to a well-understood, specific resource shock. There is also an immediate, clear-cut priority: saving people from the cold. This means we have some basis for rationing through price controls, which will likely put industrial customers last. And crucially, there appears to be broad agreement on the necessity of price interventions, ensuring that rationing is politically legitimate. So far, there is seemingly a consensus for European natural gas due to the extremity of events.

And even looking beyond wartime conditions, there are examples of price controls in our everyday midst that pass by our notice. Utility rates are often set by state government utility boards according to a defined procedure. This is certainly a price control that emerged because utilities, authorities, and consumers had overlapping interests in preserving and controlling natural monopolies. The price of healthcare in the United States – a major contributor to inflation – is a version of a market so imbued by explicit or implicit government subsidies and natural monopolies that it should also be a candidate for price control.

There are many tools in the arsenal to deal with inflationary spikes caused by disruptions that might work far better than interest rate hikes. Indeed, even if this inflation is transitory and contained by a gradual re-emergence from the COVID crisis and the Ukraine War, and business investment creates new capacity to meet demand, we should still be examining them. Climate change is an irreversible reality, and with it come many unpredictable shocks. The road ahead is bumpy.